[ad_1]

Raising cash on Wall Street is becoming increasingly difficult as market gyrations close the door on big initial public offerings and the Federal Reserve’s turn to a more restrictive monetary policy forces companies to pay up to borrow through debt markets.

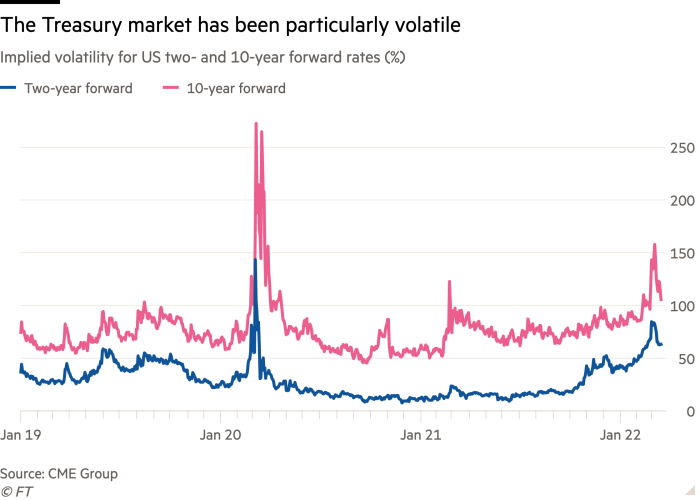

The dramatic tightening of financial conditions over the past three months has accompanied violent swings in stock, bond and Treasury securities. The price moves have inflicted losses on fund managers and sapped some of the speculative energy from US financial markets.

Borrowing costs for companies and individuals have been rising since late December, after Fed policymakers indicated they were prepared to cool the economy to tamp down rampant inflation. This week US government bond yields rose to their highest level in nearly three years.

Those yields are the risk-free benchmark for virtually all financial markets, and increases bleed through to everything from home mortgage rates — which last week eclipsed 4 per cent for the first time since 2019 — to the cost of raising corporate debt.

“The marginal higher-risk company is having a more difficult time accessing capital than they would have a month ago,” ??said Steven Oh, the head of credit and fixed income at asset manager PineBridge. He added the Fed wanted “to dampen excess demand, and the way you dampen that excess demand is tightening financial conditions to the consumer and businesses and beyond”.

Treasury yields have climbed as investors raise their forecasts for how high inflation will run, figures that have been pushed up by higher energy costs linked to the Russian invasion of Ukraine, which has rocked commodity markets.

In the days leading up to the Fed’s decision to raise interest rates last Wednesday, a closely followed gauge of US financial conditions produced by Goldman Sachs showed tightness in financial conditions nearly at levels recorded just before the coronavirus pandemic.

“We know the economy no longer needs or wants this very highly accommodative stance,” Jay Powell, Fed chair, said after the central bank’s monetary policy committee meeting. “It’s time to move to a more normal setting of financial conditions. And we do that by moving monetary policy itself to more normal levels.”

While financial conditions eased slightly immediately after the rate rise — thanks largely to a rebound in the stock market — Powell on Monday reiterated that the Fed could soon reduce its $9tn balance sheet, which would tighten conditions further.

Financial markets have spent much of this year girded for higher interest rates. New public listings have slowed to a standstill in the US, with no big IPOs between February 17 to March 14, according to Dealogic. Outside of a holiday period, it marked the longest period without one since 2017.

Separate data from Refinitiv showed that cash raised through equity sales has fallen 88 per cent from the previous year to $23.8bn, marking the slowest start to a year since 2009 — the midst of the financial crisis.

The drop-off in flotations has been prompted by high volatility across financial markets and a sell-off that has wiped more than 31 per cent off the average company in the Russell 3000 index — one of the broadest US stock market gauges.

Companies have also shied away from US debt and loan markets where trillions of dollars are borrowed each year for businesses to fund their operations. Riskier companies whose bonds are rated junk by the big debt rating agencies have borrowed just $38.8bn this year, down 71 per cent from a year prior.

This month, banks led by RBC Capital Markets pulled a $1.7bn loan deal to fund SS&C Technologies’ takeover of software company Blue Prism after facing weak demand, one person familiar with the matter said. Electric carmaker Tesla delayed a planned asset-backed debt sale , Bloomberg reported, as has buy-now, pay-later company Affirm.

Companies that have moved ahead with debt offerings have encountered far more demanding investors. Last week, bankers at Bank of America and Citigroup had to offer discounts to investors on a bond and loan deal to fund the takeover of pump manufacturer SPX Flow by private equity group Lone Star, according to people briefed on the matter.

That the arrival of tighter financial conditions preceded the Fed’s decision to lift interest rates signals that policymakers’ tough talk on inflation allowed the market to temper activity without a traditional central bank intervention. Investors said that could ultimately mean the Fed may not have to raise rates as aggressively in order to rein in inflation.

“There is a little bit of a game here where the Fed can use some of this hawkish talk to tighten without actually having to tighten,” said Ashish Shah, a chief investment officer at Goldman Sachs Asset Management. “That buys them the ability to be a little bit more flexible if the data comes out weaker.”

[ad_2]

Source link