[ad_1]

This article is an on-site version of our Unhedged newsletter. Sign up here to get the newsletter sent straight to your inbox every weekday

Good morning. Ethan here; Rob returns next week. Many thanks to my markets colleagues Kate Duguid, Eric Platt and Joe Rennison for their help in his absence.

A month ago, and for many months before that, markets were having a grand argument about inflation. Would inflation be transitory or persistent? Was it pandemic-driven or more broad-based? Though contentious, it was an intellectual feast for those involved. Unhedged has pumped out a bazillion letters on the nuances and vagaries of the great inflation debate .

These questions still matter to an extent, but the ground has shifted. Many economies’ fates now depend on political and military decisions made by world leaders. Market participants are reading sanctions law and eastern Europe experts, not economists. (Or, as one strategist told me, economists’ digests of sanctions law and eastern Europe experts.)

It is in this context that I read Thursday’s consumer price inflation report. Below, I try to learn something from it. Also, your thoughts on oil spikes and stagflation. Email me: [email protected].

Markets shrug off the bad CPI report

Here’s the good news. Core inflation (ie, exempting volatile food and energy) fell a bit in February:

Pandemic inflation anomalies are settling down. In month-over-month terms, used car prices dipped. Durable goods inflation decelerated sharply last month. Furniture and bedding prices, up some 17 per cent since 2021, were near flat.

That dash of optimism was swamped by the bad news. Surging food and energy costs gave us Thursday’s headline number, a 7.9 per cent annualised CPI print. To state the obvious, inflation is hot. It is also getting stickier. As durable goods inflation relents , core services prices are accelerating (6.2 per cent annualised, versus 4.9 in January). Rent inflation, at 7.4 per cent, is sticking, too.

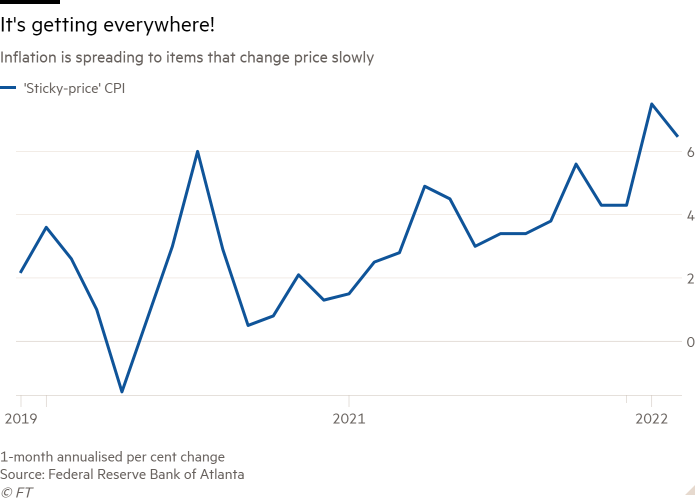

Last month, Unhedged looked at the Atlanta Fed’s sticky price inflation index, which tracks items whose prices respond to market conditions more slowly. The measure has since decelerated from 7.5 to 6.5 per cent — cold comfort for the fearful:

In sum, the inflation report offered plenty of fodder for a market freakout. Yet none happened. The S&P 500 was down, but barely. A hot CPI print was expected, and besides, there’s plenty else to fret about. BMO’s Yung-Yu Ma put it well:

Eight per cent inflation almost flew under the radar because, one, it’s probably going to be higher next month. And two, what we believed a month ago to be the dynamics of these inflation drivers — it’s not that they’ve gone away, but new dynamics have now superseded them.

Doughnuts illustrate the point. They were 4 per cent more expensive in February than in January. Grain prices have since hit record levels — something not captured in February’s CPI report. So expect blistering doughnut inflation in March and April, but what they’ll cost in December is unclear. If a settlement is reached in Ukraine and western sanctions are lifted, grain flows can resume. Doughnut prices would calm down. But in a world of indefinite economic war, all bets are off.

Ma said that if this commodities spike is a one-off, US consumers can stomach it and inflation will probably peak in the summer. More painful would be if Russia and the west cannot come to an agreement, prompting further shocks. In both cases, more turmoil lies ahead. The Federal Reserve may have little choice but to tighten monetary policy steadily and accept inflation isn’t in its control.

I admit these are hypotheticals. Scenario-planning seems about all you can do right now, as Phil Orlando of Federated Hermes told me:

As investment professionals, we’re trained to study all the data and put together this beautiful plan of exactly what to do. And we’ve got this giant elephant in the room that we can’t quantify.

A scary period in history makes for a disturbing time in markets. Be careful.

Readers respond on oil shocks and stagflation

Tuesday’s letter on whether oil shocks ultimately fuel inflation generated the most mail in one day I’ve yet gotten. Writing about inflation tends to do thatfor some reason.

The traditional argument starts with the 1973 oil embargo, where an energy spike was the prelude to out-of-control inflation expectations and a nasty recession. The experience made the 1970s synonymous with stagflation. But some think expensive oil could as easily damp inflation over time by depressing demand and growth. Which is right?

One reader, Thomas Mayer, thinks I missed the monetarist elephant in the room:

Discussing this question without bringing in the monetary overhang created by excessive credit extension seems to me like performing Hamlet without the Prince of Denmark. Compare the present situation with that of the 1970s. It is frighteningly similar.

At the beginning of the 1970s, economists disregarded the role of money in generating inflation like we do now. In the course of the 1970s, the profession rediscovered the ancient quantity theory of money and the associated quantity equation. Milton Friedman elevated it as “monetarist theory” to the dominant paradigm in economics during the decade. Paul Volcker used it to break the inflation spiral at the beginning of the 1980s. I wonder when the next Milton Friedman will come up.

In other words, to focus on oil is to miss the point. Inflationary or not, oil’s impact is surely dwarfed by too much money chasing too few goods. This could be, but I’m not sure. Quantitative easing probably matters for inflation, but does it matter in the absence of fiscal expansion? If you know the answer, there’s an economics Nobel Prize waiting for you.

Several readers flagged differences in labour power between the 1970s and today. Hasan Choudhury wrote:

The thing I most notice about the various commentaries on stagflation is the role of labour unions. In the 1960s and 70s and into the early 80s, the workforce was much more unionised in both the UK, Europe and the US. This allowed them to enforce their higher wages demands.

This time round, notwithstanding tight labour markets, labour is not as organised as in the previous period of high inflation caused by OPEC policy. I can’t see individual employees getting matching pay rises en masse as in the 70s.

This is probably a big reason why most hawks don’t think 14 per cent inflation is imminent. Diminished labour power is a serious drag on how high inflation can go. “We’re risking a 1970s scenario” often is a claim about direction, not magnitude.

Finally, a provocative suggestion from Nigel Hayes of EADA Business School:

Under the circumstances, why don’t the EU (and Norway and the UK) and the US temporarily fix the price of oil and gas? Together they could perhaps provide 80 per cent of their energy needs, and even if the price was fixed at , say, 50 per cent of the global market price, the “temporarily nationalised” companies would still make substantial profits.

This action would immediately undercut Russian gas supplies and perhaps break the consumer-led inflation spiral you discuss. Politically unacceptable? Perhaps. But it could be done on a temporary basis.

Maybe this idea would just never work. But if there is any time where it would, it would surely be now.

One good read

How Facebook’s crypto dreams fell apart.

[ad_2]

Source link