[ad_1]

Doug Irwin of Dartmouth gave a really informative talk at the Hoover Economic Policy Working Group, based on his paper The Trade Reform Wave 1985-1995AER May 2022. Embed (hopefully) below, or go to the link here.

Doug opened my eyes, hence this post. I love learning something new. I’m a resolute Free Trader. So, naturally, I jump to the answer: Stop protecting industries. Get rid of tariffs. Don’t bother with the negotiated mercantilism of trade deals — the “you can sell to us if our exporters can sell to you” deals. The point of a foreign country’s exports is to get dollars, and the point of dollars is for them to buy from the US. Full stop .

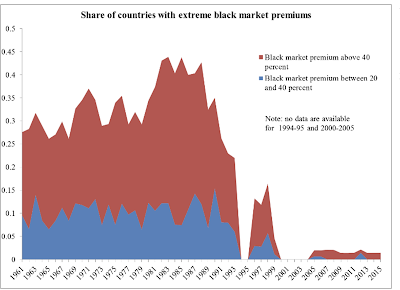

Doug reveals that this story is far too simplistic to understand the closed economies of the 1950s through 1970s, and the great trade liberalization that the world experienced starting in the 1980s — and which we are very sadly likely to lose in the years ahead. A little reminder of what we gained, and a sad peak:

The process of liberalization started with money, not tariffs: Countries first devalued overvalued currency, usually to a floating rate. Then they eliminated quantitative restrictions on imports including import licenses. Then they reduced tariffs.

In turn, how did they get there, and why did they not reform earlier? The standard story pits domestic industry vs. consumers. Domestic industries have concentrated interest in protection, consumers are diffuse. That accounts for status quo bias, but not why they eventually changed.

The source of the problem, and reason for the change is different. Countries (especially in the “developing” world) were hit with a “terms of trade” shock — they exported commodities, say, to import goods; the commodity price went down so they could not buy imports. Many countries were financing imports with foreign aid and borrowing, and those transfers dried up.

What do they do? They have to choose between deflation, currency depreciation, or import controls. Deflation at the same exchange rate makes foreign goods more expensive. Depreciation does the same, without changing the domestic price level. Or, stop imports by direct controls , and by rationing foreign exchange leading to a black market. In the early postwar view, consistent with Bretton Woods, they chose the latter. (Why is there so much nostalgia for Bretton Woods? It was a rotten system.)

Naturally, it didn’t work. Eventually they gave up and devalued or floated the exchange rate. Now there is no need to ration foreign exchange or to restrict imports by license. (Tariffs are bad, but quantitative restrictions are worse, since you never know what the cost is, and then imports are allocated by political rather than economic reasons. Just paying a tax is more efficient!) They moved to exports in order to generate foreign exchange to buy imports.

So, Doug answers the central question:

Why no reform in 1970s? “foreign exchange reserves kill the will to reform”

Oil and commodity export countries were flush with cash to buy imports. Foreign aid recipients had cash to buy imports.

Why reform in the 1980s?

Era of scarce foreign exchange – all three BOP shocks.

Goal: increase foreign exchange earnings by increasing exports.

Learning from experience – cost of import controls, benefit of exports

Shift from import repression to export promotion to overcome foreign exchange shortage

And, later,

Michael Bruno (World Bank): “We did more for Kenya by cutting off aid for one year than by giving them aid for the previous three decades”

Aid lets a country put off reform.

I asked one question, about the importance of an open capital account. That also used to be gospel, now under debate. Doug’s answer was interesting: In these cases, a free currency market was crucial, but free capital markets less so.

Ideas matter.

This process did not just play out in standard political economy terms, one interest group gains power over another. The shift of ideas in universities, the IMF, central banks, and countries was crucial. I find this heartwarming as a producer of ideas, and terrifying as I watch these successful ideas crumble around me.

Doug discusses the process of reform in Mexico, (which first had disaster under some bad ideas, then reform when a new group of economists came in), India, South Korea and others. Listen to the talk!

Concluding slides:

[ad_2]

Source link