[ad_1]

The World Bank has warned that the war in Ukraine could cause lasting damage to the economies of low- and middle-income countries, pushing millions into poverty and plunging dozens of countries into debt crises.

Indermit Gill, the bank’s vice-president for equitable growth, said high commodity prices, collapsing trade growth, rising interest rates and a stronger dollar would exacerbate fiscal pressures in many countries, making it particularly difficult for net importers to service mounting debt, financial and institutional.

Oil prices soar and wheat Unless the war ends quickly, that alone will be enough to seriously hamper growth in many developing countries, he added. Oil-importing countries such as China, Indonesia, South Africa and Turkey are particularly at risk.

“If wheat and oil prices remain high for six months to a year, that would take a percentage point off the growth rate we forecast a little over a month ago,” Gill said.

Growth in developing countries had been declining for a long time before the war, he noted. In January, the World Bank forecast output growth in developing countries to average 6.3 percent in 2021, 4.6 percent this year and 4.4 percent in 2023.

A drop of one percentage point in growth may be manageable in some Asian countries, “but for Turkey or Brazil, it’s huge,” Gill said.

Last year, the bank warned that about 100 million people would fall back into poverty, which it defined as living on less than $1.90 a day, or would be pushed back into poverty for the first time as a result of the coronavirus pandemic. Gill said that while it was too early to predict the impact of the war, the number was now sure to rise.

About 40 low-income countries are already in debt distress or at risk of debt distress due to the pandemic, he said, adding: “With war, debt crises could come sooner, which could cause a lot of permanent damage. .”

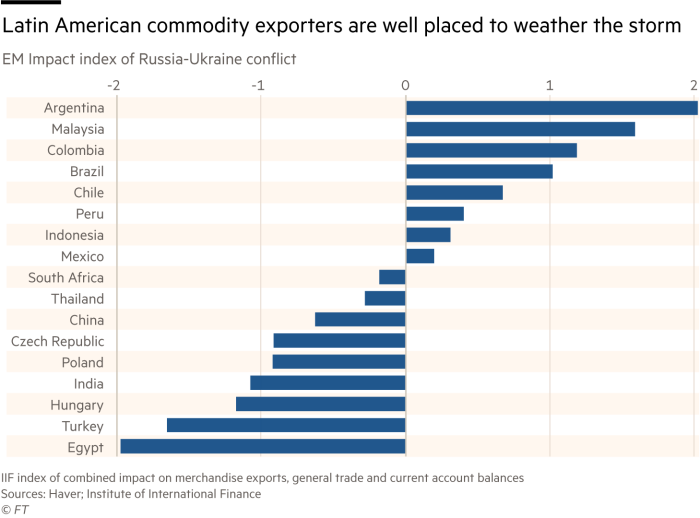

Analysts said the economic impact of the war would not be evenly distributed and could be exacerbated by further disruption to supply chains from China’s Covid-19 restrictions. A recent report by the Institute of International Finance (IIF), the financial industry association, compares the impact of war on emerging markets through the impact of commodity exports, aggregate trade and commodity prices on current account balances.

Central European countries such as Poland, the Czech Republic and Hungary were particularly affected by disruptions to trade with Ukraine and Russia, while Turkey and Egypt were more affected by trade and their reliance on oil and wheat imports, the study found.

Commodity exporters in Latin America stand to benefit from higher food and fuel prices, the IIF noted. But it warned that the war and any further escalation of sanctions on Russia could lead to indiscriminate capital outflows from all emerging markets.

Some of the countries with the greatest economic risk, including Egypt, Turkey, India, South Africa and Thailand, have good relations with Russia, said Mark Rosenberg, chief executive of political risk consultancy GeoQuant.

Although this will allow them to continue importing Food or fuel from Russia, as India doeswhich could also expose them to greater exposure to Western sanctions against Russia and its trading partners.

Rosenberg said Egypt was most vulnerable to war given its high risk of trade relations and political instability.Last week, the country demanded IMF supportHe added that India is also vulnerable to geopolitical tensions that have “damaged its relations with countries that have formed anti-Russian alliances”.

The World Bank’s Gill said the economic damage from the war was likely to be worst hit in countries with little or no economic ties to Russia, such as Ghana and Sri Lanka, but those economies would suffer from trade disruptions and worsening global financial conditions. damage.

Many countries have limited pandemic-related damage by supporting businesses and households through debt-financed public spending, helped by extremely low global interest rates and ultra-easy central banks in advanced economies. But with global monetary policy tightening, developing countries have exhausted the fiscal space they have.

“The damage from the pandemic is reversible because it can be addressed through domestic policy,” Gill said. “But we are very concerned about the war. It is not in the hands of domestic policymakers and this could lead to irreversible effects.”

Trade secrets

The Business Confidential Newsletter is the FT’s must-read email on the changing face of international trade and globalisation. Written by FT trade expert Alan Beattie, delivered to your inbox every Monday. register here

[ad_2]

Source link