[ad_1]

This article is an on-site version of our Unhedged newsletter. Sign up here to get the newsletter sent straight to your inbox every weekday

Good morning. Wednesday was a good day for officialdom. A day after Unhedged wrote about the epic collapse of China’s stock market, a vague vague statement from vice-premier Liu He about forthcoming “policies favourable to the market” trigged a furious rally. Across the Pacific, the Fed signalled a string of rate increases and the market rose nicely. Economic fundamentals declined to comment. Email us: robert. [email protected] and [email protected].

The Fed wants to stop inflation without getting anyone fired

In January, Jay Powell promised he’d follow the data, and since then inflation readings have come in hot and sticky. Yesterday the Fed chair kept his promise with a big shift in central bank policy. Expect seven quarter-point interest rate increases this year; balance sheet reduction will start soon, too, perhaps in May.

Below are “dot plots” showing each Fed board member’s expectation for where the policy rate is going. The left side from December, and the right from yesterday:

The 2022 columns show Fed members revising up their projections from a median policy rate of 0.9 per cent to 1.9. Importantly, expectations for 2023-24 were also bumped above the anticipated “longer run” rate. As Morgan Stanley’s Jim Caron explained:

The surprise from the Fed meeting was their median projection for policy rates to reach 2.8 per cent in both 2023 and 2024, which exceeds their neutral rate projection of 2.4 per cent. This represents a change in their communication in that they are signalling a move toward a tightening of financial conditions instead of just moving to neutral.

This year’s inflation data has made the case for tightening decisive. Higher prices are seeping into stickier areas such as services and rent. Predictions that easing supply conditions would soothe inflation haven’t yet panned out, as Powell noted in his press conference:

The help we have been expecting, and other forecasters have been expecting, from supply-side improvements, labour force participation, bottlenecks [getting better] hasn’t come.

How fast to tighten? On this question Fed officials are more divided than ever. St Louis Fed president James Bullard called for a half-point increase in yesterday’s meeting, though he was alone in his dissent. But the board’s range of opinion on the appropriate number of rate increases has blown wide open:

In a moment of great uncertainty, as Russia’s war is reshaping the world on the heels of a pandemic, this should not be surprising.

Stocks, having spent weeks in worry mode, were satisfied with the Fed’s message. A relief rally brought the S&P 500 up 2.2 per cent and the Nasdaq up 3.8. The yield curve sent a muddier sign, finishing flatter. The 10-2 yield spread is just 25 basis points from inverting, hinting at a higher probability of recession.

A striking feature of the Fed’s more vigorous approach to inflation is that both chair and board appear to think inflation can be brought down without giving up any of the recent gains in the labour market. In the press conference, Powell repeated that the number of job openings far exceeds that of unemployed workers, creating the potential that the economy could cool without putting anyone out of work. The board, meanwhile, projects sub-4 per cent unemployment through 2024, despite lots of rate increases and balance sheet runoff.

Is it possible to subdue high and pervasive inflation without costing anyone a job? The Fed hopes so, and so do we. But it’s a cruel old world out there. (Ethan Wu)

Gold revisited

It is intuitive that gold would be a popular asset at moments of geopolitical stress. It is an ancient, simple, politically neutral asset weakly correlated with volatile equities. Well, if there was ever a stressful and uncertain geopolitical moment, we are in one now . How has gold acted?

Here is a chart of the gold price and real interest rates (as represented by the yield on the 10-year inflation protected Treasury) since the pandemic began:

The reason for including real rates is that — as we repeat here ad nauseam — they are the starting point for any gold analysis. Real rates are the opportunity cost of holding yieldless gold. So there is a broadly reliable inverse relationship between the two. It is the periods when gold and real rates ignore one another, or even move together, that are interesting. As we pointed out a month ago, there was an extended period of positive correlation between the beginning of this year and the last week of February. One explanation of this is a grab at stability and reassurance in a mad world of spiralling inflation and the threat of war.

There is other evidence of increased gold demand in these frightening times. Garrett DeSimone of OptionMetrics pointed out the recent “negative skew” in gold options. This is a measure of the difference between the premiums paid for gold calls (long options) and gold puts (short options). Below is a chart of the skew. Without going into the technical details, a decline in the chart shows investors paying relatively larger premium for long exposure to gold:

More confirmation of crisis gold demand is found in the holdings of gold ETFs. Here is their aggregate holdings of gold, in millions of ounces:

Capital moved into gold through ETFs in a hurry in the scary early days of the pandemic, and it is doing so again now, in the shadow of war. But here’s a puzzle. If the options markets and gold ETFs show strong, likely fear- driven gold demand, why has the gold price turned south since it broke $2,000 on the eighth of March?

The easy answer is that real rates started to rise then. But there may be another aspect to the situation, too.

Note how the last gold rally, in the first seven months of 2020, also reversed rapidly after it broke the $2,000 threshold. A longtime gold market participant (who wished to remain nameless) argued to me that as gold approaches that level, it starts to kill demand in the retail market for physical gold, which is dominated by India and China. Unlike buyers who buy gold in a brokerage account, never touching the metal itself, Indian and Chinese buyers are acutely price-sensitive. It makes matters worse for these buyers that gold rallies driven by geopolitical stress tend to be accompanied by a stronger dollar, which makes gold even more expensive for them.

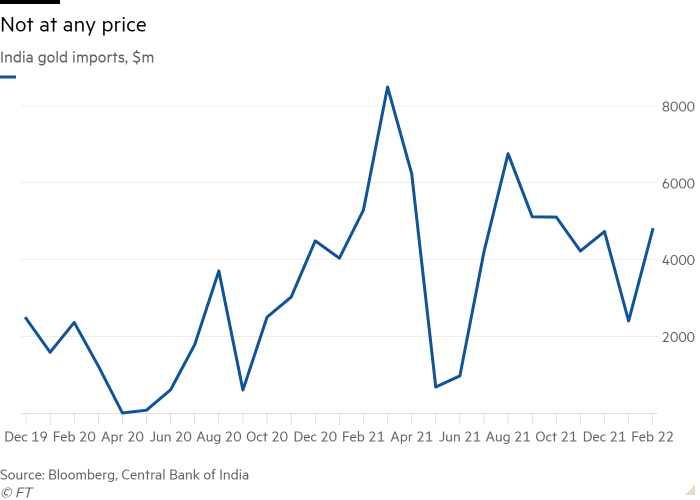

Indeed, gold imports to India peaked in the spring of 2021, in the trench between the price peaks of 2020 and 2022 — and fell 10 per cent in February versus the prior year, to $4.8bn.

If this account is correct, it makes the gold market much more interesting. It begins to look like a wrestling match between two groups of buyers: price-insensitive electronic buyers who use gold as a diversifier, and price-sensitive physical buyers who use gold as a store of value.

One good read

We were happy to see the WSJ’s editorial board take on the SEC’s proposed private market reforms, which are important and neglected. But they are wrong to say that the agency’s aim is to “erase the distinction between public and private companies so [SEC chair Gary Gensler] can foist new ESG disclosures across the economy”. If there is a grand scheme here, it is to push more companies on to public markets. ESG, dumb as it is, has little to do with it.

[ad_2]

Source link