[ad_1]

In less than a month, Russia has moved from an emerging market country to a pariah nation. They have been cut off from western markets, removed from the financial system, and essentially isolated economically. The thinking among NATO leaders is that their economy will crumble , and their people –oligarchs and populace alike – will not tolerate this situation.

Their biggest lifeline? A massive neighbor to the south, with whom they share a 2,615-mile border: China.

The People’s Republic of China has a voracious appetite for raw materials, energy, and economic growth. Even if Russia is cut off from most of the industrialized economies of the world, they still have a ready market in China’s economy – the second largest and one of the fastest-growing economies in the world.

This would not be a permanent arrangement. I cannot imagine Vladimir Putin allowing Russia to become a client state, subservient to Xi’s China; his motivation for invading Ukraine seemed to be premised on recapturing the glory days of the former Soviet Union.

But it raises the interesting question of how fully integrated into the western financial and economic system China is. Whether their own specific needs and relationships with the various countries on their borders — including North Korea and Russia — will eclipse Western values.

We have considered this unresolved question before, most recently in “How much is the rule of law worth to markets?

Each time an issue erupts in some rogue state, my go-to expert is Perth Tolle. She runs the Freedom 100 Emerging Markets index/ETF (FRDM).1 The basis for the index she manages is based upon “quantitative personal and economic freedom metrics,” and her ETF selects the 10 biggest companies in each of the 10 highest-ranked countries.

Putin’s unprovoked invasion of another sovereign country, the video that we’ve seen of indiscriminate shelling of civilians (including women and children) and the real possibility of war crimes, has made Russia in the words of MSCI,”uninvestable.”

Might China suffer a similar fate?

The country is far more powerful than Russia, with greater economic ties to the West than the former Soviet Union has. Given the size of their population and their growth trajectory, it is inevitable that China will eventually be the largest economy in the world. This makes it highly unlikely that they could be economically isolated in ways that Russia is facing.

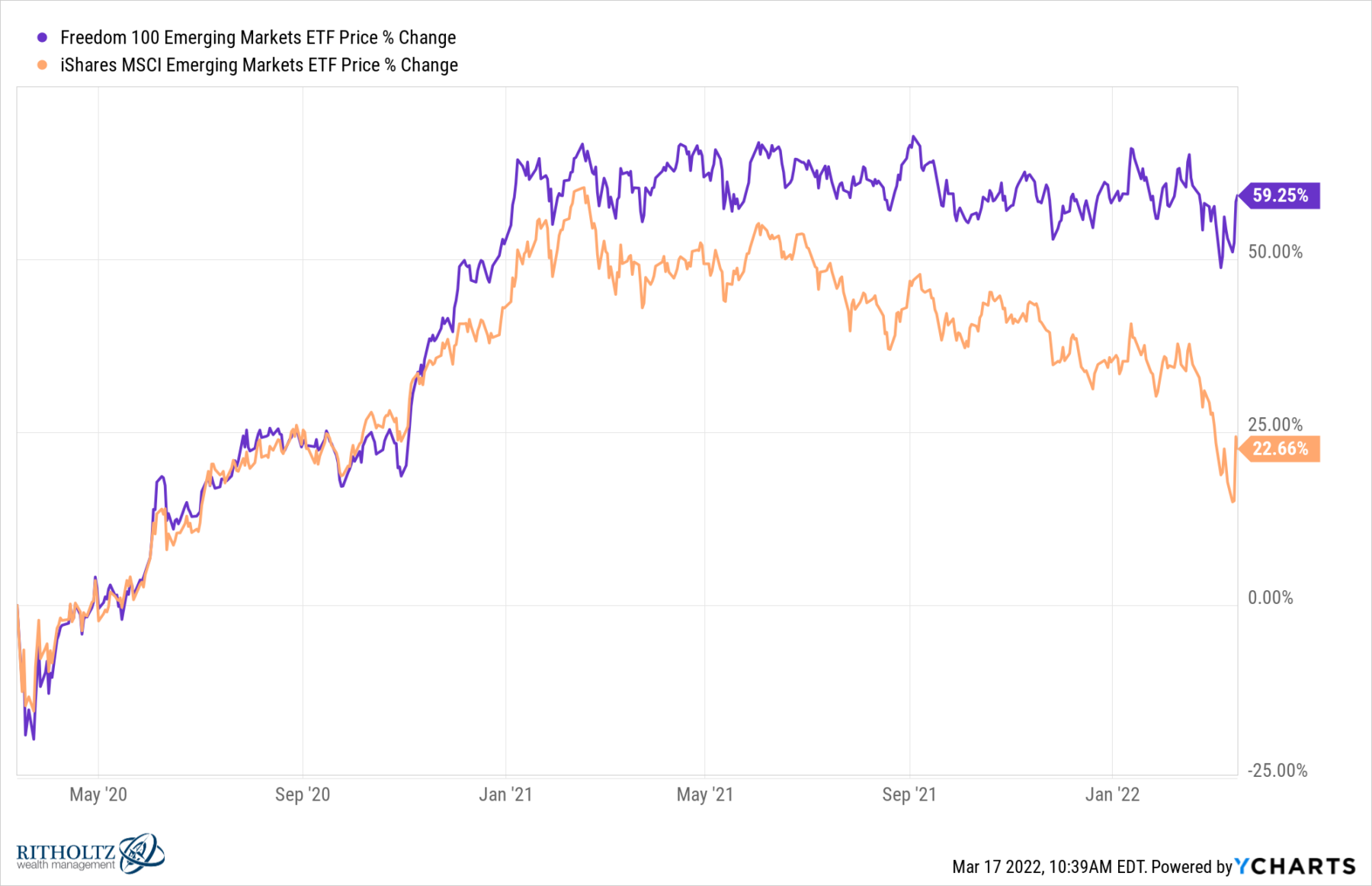

China is about 30% of most emerging market indices. If we look at how well EM markets have done those funds that have avoided nations like Russia and China have been outperforming. Consider Perth’s ETF, which has opened about a ~35% performance gap between itself and competitors that still have holdings in Russia (written down to zero) and China since mid-2020. 2

Yesterday China announced support for its tech industry and its markets bounced 7%, and the Hang Seng Tech Index jumped 22%.

A question facing investors is whether or not they want to participate in China’s markets. Will Xi offer a lifeline to Putin? Will they continue to subsidize Russian aggression? Are they funding the war machine attacking women and children and civilians?

I have no idea what investors will do collectively. The potential for growth makes investing in China very tempting; but the risk of government intervention has – at least over the past two years – been a massive challenge. It has also led to underperformance.3

But the counter-argument is simply China’s economic growth has not been captured by stock investorsdespite the extreme growth they’ve had over 40 years. Perth makes the argument that:

“China’s growth is a story of the past. Watch what they do, not what they say. Just as with their response to the Russian invasion, they are often speaking out of both sides of their mouth. Their economic freedom has declined drastically under this current regime, there is a reversal of the policies that made China prosperous. And their Tech companies are now a threat to the regime, because of the data they capture.”

This is a quandary that will be facing investors over the next few years. I honestly do not know how it resolves, but its something worth paying attention to as events overseas raise numerous challenges.

How Much is the Rule of Law Worth to Markets? (August 2, 2021)

________________

1. You can find the documents for this ETFs here.

2. See, eg, iShares emerging market ETF, EEM.

3. RWM does not have a position in FRDM, nor any interest in the Life + Liberty Indexes firm.

[ad_2]

Source link