[ad_1]

Russia’s invasion of Ukraine has created an unexpected crisis for investors — many of whom had been hoping for a return to economic normality after two years of the Covid pandemic.

Right now, the conflict threatens to disrupt supplies of essential commodities, from both Russia and Ukraine, to western economies already beset by worries about accelerating inflation. Price rises had reached multi-decade highs in the US and Europe even before the fighting began.

The ensuing geopolitical crisis has already created volatility across financial markets as investors look for ways to protect and diversify their portfolios.

And flows in and out of exchange traded funds are again providing a highly sensitive barometer of investor sentiment across all asset classes in times of uncertainty.

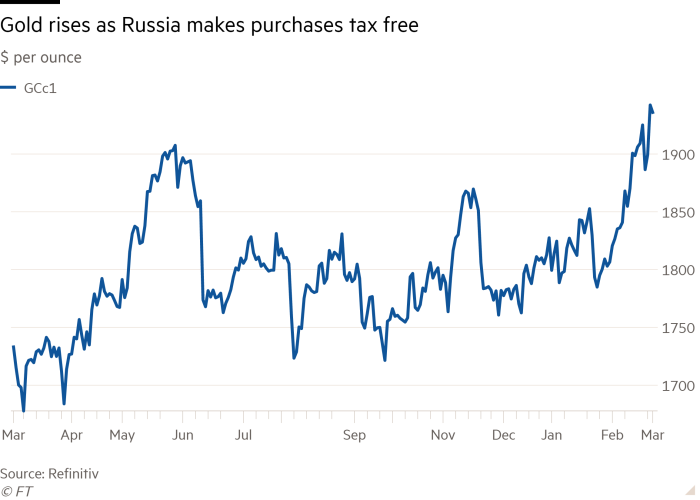

Gold — always seen as a safe haven of value in periods of turmoil — has predictably rallied. The price of the precious metal, often held by investors via exchange traded funds, has risen by 6.4 per cent so far this year, trading last week at $1,922 per troy ounce.

This spot price increase has been driven, in part, by a revival in demand for gold ETFs in the last two months.

Inflationary concerns, combined with weeks of growing tensions ahead of the invasion of Ukraine, helped attract just under $4.6bn of inflows into gold ETFs in the year so far to February 25. This took total assets in the category to $221bn — the latest data available from the World Gold Council, the trade body.

Capital Economics, the consultancy, expects the gold price to reach $2,000 an ounce due to “safe haven” demand prompted by the Ukraine crisis.

Yet a flight to gold contains its own risks. Capital Economics is also forecasting that gold will retreat to $1,600 an ounce by the end of the year, should Russia’s central bank be forced to sell down part of its substantial bullion reserves to provide liquidity for its domestic financial market.

Followers of the precious metal will also have noted that the relative economic calm of last year, following global recovery from the coronavirus pandemic, coincided with the biggest annual withdrawal of money from gold EFTs since 2013, as the metal fell out of fashion.

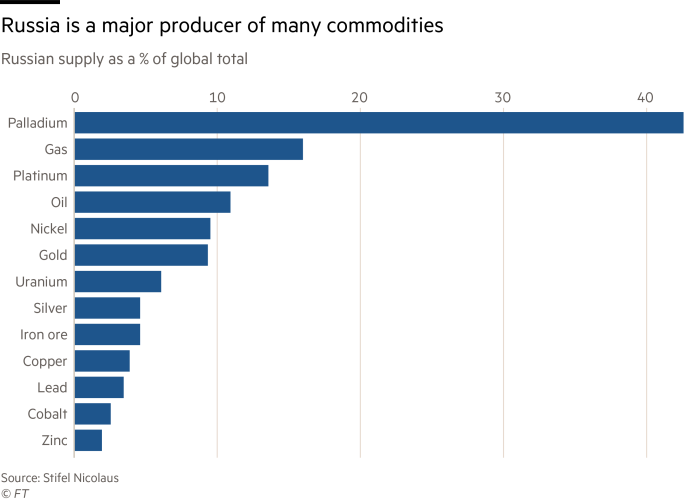

Oil and gas prices have predictably spiked higher, too, amid worries over disruptions to supplies from Russia. In addition, Russia’s role as a key global supplier of other industrial and agricultural commodities is likely to be curtailed by the strict international sanctions imposed on Moscow. However, at present, the scale of such disruption — and the impact on pricing — remains difficult to predict.

This has triggered a rush into US-listed broad commodity ETFs, which can provide exposure to a wide range of commodities. They attracted inflows of $2.5bn in February, with $1bn in new cash arriving in the final three days of the month.

“Commodity-focused ETFs are in vogue due to elevated geopolitical worries, increased inflationary concerns and the spectre of rising interest rates,” says Todd Rosenbluth, head of ETF and mutual fund research at CFRA Research.

Meanwhile, ETFs that track the share prices of companies in the US energy sector have gathered net inflows of $4.2bn so far this year, with investors betting that higher prices will boost their earnings.

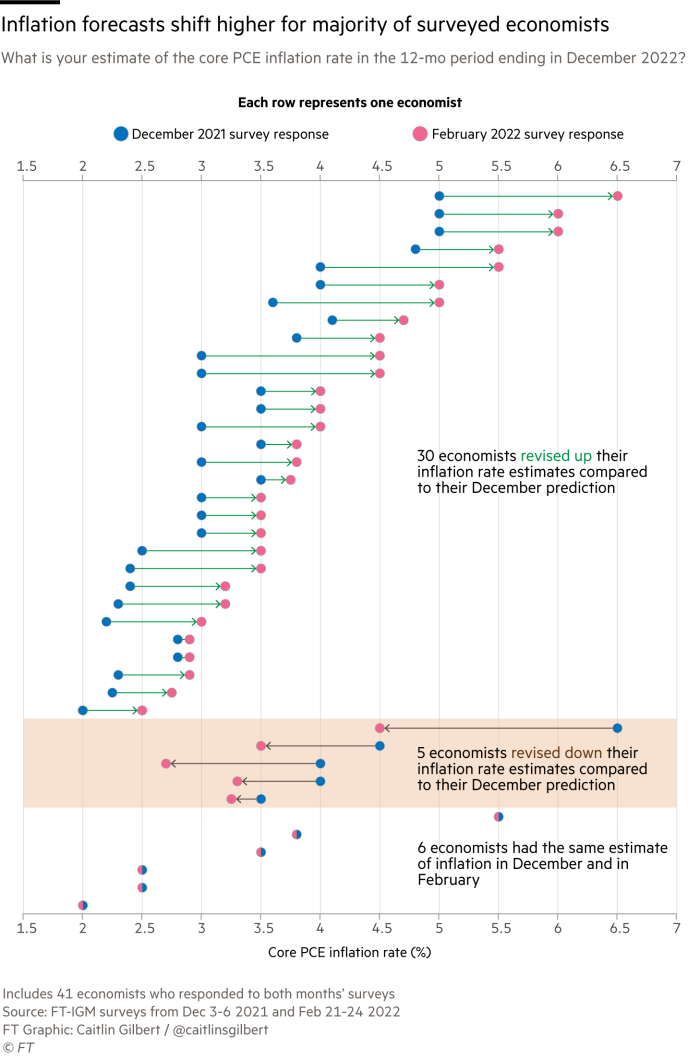

But despite inflation already returning to historic highs in the US and Europe, Russia’s actions in Ukraine may now reduce the expected scale and pace of any interest rate rises by Western central banks will be reduced. That, in turn, could result in inflation rates remaining higher than policymakers would prefer.

Michael John Lytle, the chief executive of Tabula, a London-based ETF provider, says investors will have to “increase their focus on more sophisticated strategies to address rising inflation”. Tabula offers a US enhanced inflation ETF (ticker symbol TINF), which combines US Treasury inflation-protected securities (Tips) with other real (inflation adjusted) bond holdings. The fund has delivered a net return, after fees, of 17.2 per cent since it was launched in October 2020.

Prices of conventional US, UK and German 10-year government bonds — another asset class to have traditionally proved safer than equities in periods of market stress — all rose In the days following the Russian invasion, sending their yields down.

We are in the middle of a regime shift characterised by unprecedented inflationary forces not seen in the past five decades

But Pascal Blanqué, who chairs the research institute of Amundi, the Paris-based asset manager, cautions that the “apparent renewed attractiveness of core government bonds is a trap” — because they do not reflect the risk that inflation rates will remain high.

“We are in the middle of a regime shift characterised by unprecedented inflationary forces not seen in the past five decades,” argues Blanqué. He recommends that investors look for assets that are positively correlated with inflation — including commodities, value stocks, and companies paying high dividends.

US companies paid out a record $522.7bn in dividends in 2021 and Janus Henderson, the asset manager, is forecasting that this will increase to $562bn this year.

Matteo Andreetto, the head of State Street’s ETF business in Europe, says this strengthens the attractions of so-called dividend “aristocrat” ETFs that invest in companies with an unbroken history of payouts.

He favours US mid-cap ETFs, as well, as he believes they are trading on undemanding valuations and less exposed to any Russia-related disruptions.

State Street is also advising clients to consider ETFs with exposure to Chinese treasury bonds which are offering a real, inflation-adjusted, yield of around 1.7 per cent.

“China’s central bank is likely to ease monetary policy to help support its economy at a time when other central banks are looking to raise interest rates,” says Andreetto. “So Chinese treasury bonds can provide a useful role in diversifying risks in fixed income portfolios .”

[ad_2]

Source link