[ad_1]

Jay Powell has always said the Fed is willing to take out the hammer to keep prices down if inflation is in danger of getting out of control.

On Wednesday, in his most hawkish news conference since the start of the pandemic, the Fed chair clearest signal However, such a moment is fast approaching.

“Powell is basically saying to the market and the economy, ‘fasten your seat belts, we’re getting ready to take off,'” said Nathan Hitz, Citigroup’s chief global economist and a former U.S. Treasury secretary. “The Fed is prepared to act aggressively if inflation doesn’t drop as they expect.”

The Fed’s push to tighten policy can be seen not only in Powell’s remarks about the path forward for monetary policy, but also in his refusal to reveal the content of the Fed’s interest rate plans later this year.

“Powell is clearly reluctant to rule out more frequently [or] More rate hikes,” Sheets said.

Powell made it clear that the first hike to the main policy rate since 2018 is almost certain to happen at the next meeting in March. But he was opaque about what to expect after that and left the door open to stronger action to cool the U.S. economy.

Despite multiple opportunities to reiterate the FOMC’s preference for an “incremental” approach to rate hikes — which he spoke about most recently at last month’s meeting — Powell has repeatedly sidestepped questions about the central bank’s view that inflation appears to be persistent .

In place of “gradual” is another slogan, “flexible,” which traders interpret as a newfound willingness to embrace more aggressive tightening cycles.

When asked whether the Fed would consider raising rates at each subsequent policy meeting this year, which would lead to seven hikes in 2022, he simply said no decision had been made.

He also declined to rule out the possibility that the Fed will raise rates by half a percentage point at an upcoming meeting, double its typical 25 basis point cadence. The central bank has not implemented a 0.5% rate hike for more than 20 years.

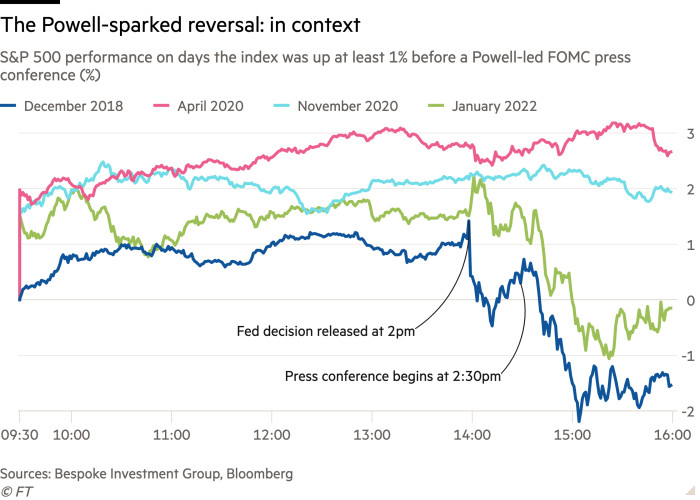

U.S. stocks balked at the Fed chair’s hawkish stance. At Powell’s post-meeting news conference, the S&P 500 sell-off was the benchmark’s worst performer, according to research firm Bespoke Investment Group.

The S&P 500 closed down 2.2% as Powell answered questions from reporters.

The only time the market sold more was when Powell stood up at the press conference, Bespoke noted. December 2018which rattled markets when the chairman pushed ahead with policy tightening amid then-President Donald Trump’s trade war.

Ellen Zentner, chief U.S. economist at Morgan Stanley, said Powell was “deliberately vague” in keeping all Fed policy options open at a time when the economic outlook has historically been difficult to assess.

Whether that means an “early” rate hike from March, or more evenly throughout the year, is unclear, but the market is now bracing for a variety of scenarios.

“The Fed’s boilerplate approach is to maintain maximum flexibility,” Zentner said, noting that Powell’s “hawkishness” showed on Wednesday. “The economy could have us in trouble at any given time, so you can’t really communicate the policy path because it’s highly uncertain given the high degree of uncertainty in the outlook itself.”

“Powell has definitely upped the ante in terms of conveying a more hawkish tone,” said Yvette Klevan, fixed income portfolio manager at Lazard Asset Management.

She suggested that a 0.5 percentage point increase in March might be “excessive,” but given Powell’s refusal to rule out such a move and the fact that upcoming data could confirm how hot the economy is, it’s “not entirely out of the question.” The US economy is.

Powell noted that the U.S. economy is much stronger than it was in 2015, when the last time the Federal Reserve started a rate hike cycle. At the time, the central bank took a cautious approach to tightening policy.

But Powell’s remarks on Wednesday shed light on the fact that the central bank may act sooner this time around, pulling interest rates back to 2.5% from near-zero levels that most officials see as sufficient to limit economic activity.

Joe Davis, chief global economist at Vanguard, believes the policy rate will eventually have to rise to 3% — well above market expectations — to dampen demand.

Powell’s argument that there is “considerable room to raise interest rates without threatening the labor market,” further cemented expectations for a more aggressive approach. The same goes for his remarks that he believes the United States has achieved full employment.

Analysts at Deutsche Bank now expect five rate hikes this year, the first three of which occurred at the June meeting. They forecast the Fed will begin shrinking its nearly $9 trillion balance sheet in July, with more details on the pace of that effort due in May.

When asked about the impact of the Fed’s newfound hawkishness on U.S. markets, which have been wobbly this year as traders position themselves for higher rates.

“The financial position reflects the decisions we make ahead of time,” he said. “Monetary policy works significantly through expectations.”

For JPMorgan’s chief Fed watcher Michael Feroli, Powell’s new approach can be summed up as: “No longer Mr. Nice Guy.”

Additional reporting by Eric Platt in New York

[ad_2]

Source link