[ad_1]

Yves here. Readers have likely worked out that your humble blogger is not all that excited about the perturbations of the equity market, particularly since even after the Fed (by accident or design) has let some air out of the bubble, stocks are still way way overvalued by historical standards. Which does not bar them from becoming even more overvalued!

In other words, wake me when NFTs crash. That would be a sign of real blood on the streets.

But the press is a bit worked up about the pain in the tech sector, hence the update.

By Wolf Richter, editor of Wolf Street. Originally published at Wolf Street

The Russell 2000 Index, which tracks 2,000 small-cap stocks, dropped 3.1% on Tuesday, to 2,096, down 6.6% year-to-date, down 1.3% from where it had been a year ago, and back where it had been on January 7, 2021. The index has whittled down its gain from its pre-pandemic peak of August 31, 2018, to 20.5%.

But that’s on the mild side of the spectrum (stock data via YCharts):

This is another aspect of how the stock market has been falling apart beneath the surface, in line with the wholesale collapse of IPO stocks, SPACs, and trackers of the most-hyped stocks, such as the ARK Innovation ETF.

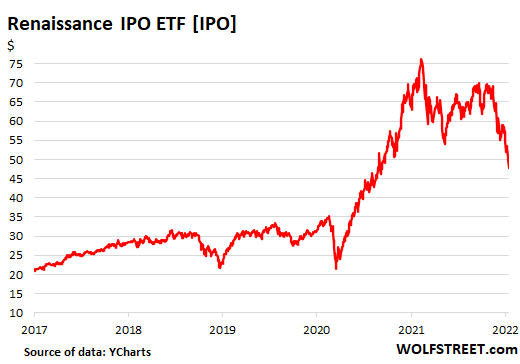

The Renaissance IPO index [IPO], which tracks stocks that went public over the past couple of years, after a blistering spike that started in March 2020 and ended in February 12, 2021, has now plunged by 37.7% from that high, to the lowest level since September 11, 2020 , with lots of air remaining below it (stock data via YCharts):

The top components Renaissance IPO index and their collapse in percent from their highs:

- Moderna [MRNA]: -62%

- Snowflake [SNOW]: -29%

- Uber [UBER]: -40%

- Cloudflare [NET]: -57%

- Zoom Video [ZM]: -73%

- CrowdStrike [CRWD]: -42%

- Datadog [DDOG]: -34%

- Coinbase [COIN]: -48%

- Palantir [PLTR]: -66%

- BioNTech [BNTX]: -63%

Among the notable IPO stocks beyond the top 10 of the Renaissance IPO Index, with the collapse in percent from their highs:

- Airbnb [ABNB]: -28%

- Peloton [PTON]: -82%

- Carvana [CVNA]: -57%

- Chewy [CHWY]: -64%

- Squarespace [SQSP]: -56%

- DoorDash [DASH]: -50%

- DraftKings [DKNG]: -70%

- Unity Software [U]: -43%

And some notable housing-related companies, and the collapse in percent from their highs:

- Zillow [ZG]: -75%

- Redfin [RDFN]: -68%

- Compass [COMP]: -63%

- Rocket Cos. [RKT]: -70%

- Lemonade [LMND]: -81%

And our space SPAC:

- Virgin Galactic [SPCE]: -85%

Our glorious EV SPACs have gotten wiped out wholesale. Here are some of the most prominent ones:

- Lordstown Motors [RIDE]: -90%

- Nikola [NKLA]: -90%

- Lucid [LCID]: -40%

- Rivian [RIVN]: -59%

- Faraday Future Intelligent Electric [FFIE]: -75%

- Workhorse [WKHS]: -91%

Even the online dating SPAC when online dating is hot:

Fake-meat producer Beyond Meat, which IPOed in April 2019, today landed below its first-day close:

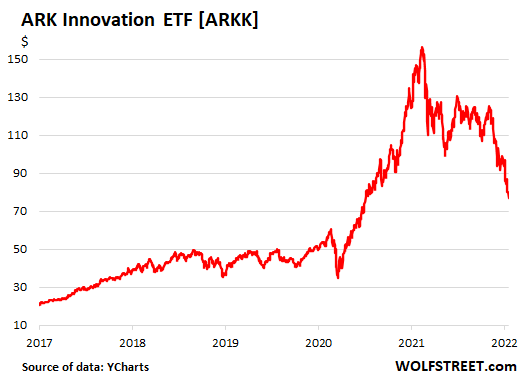

Some of these winners are tracked by the ARK Innovation ETF [ARKK], which attempts to track “disruptive innovation,” which it defines as a “technologically enabled new product or service that potentially changes the way the world works” or at least it changed the way people’s money got disappeared:

- Ark Innovation ETF [ARKK]: -52%

[ad_2]

Source link