[ad_1]

Since December 8, as many stable currency market valuations issued more tokens linked to legal tenders this month, the stable currency economy has grown by 3.59% in 17 days. On Saturday, December 25, the market valuation of the stablecoin economy of US$167 billion accounted for 6.68% of the entire US$2.49 trillion crypto market economy.

Stablecoin issuance increased by 3.5%

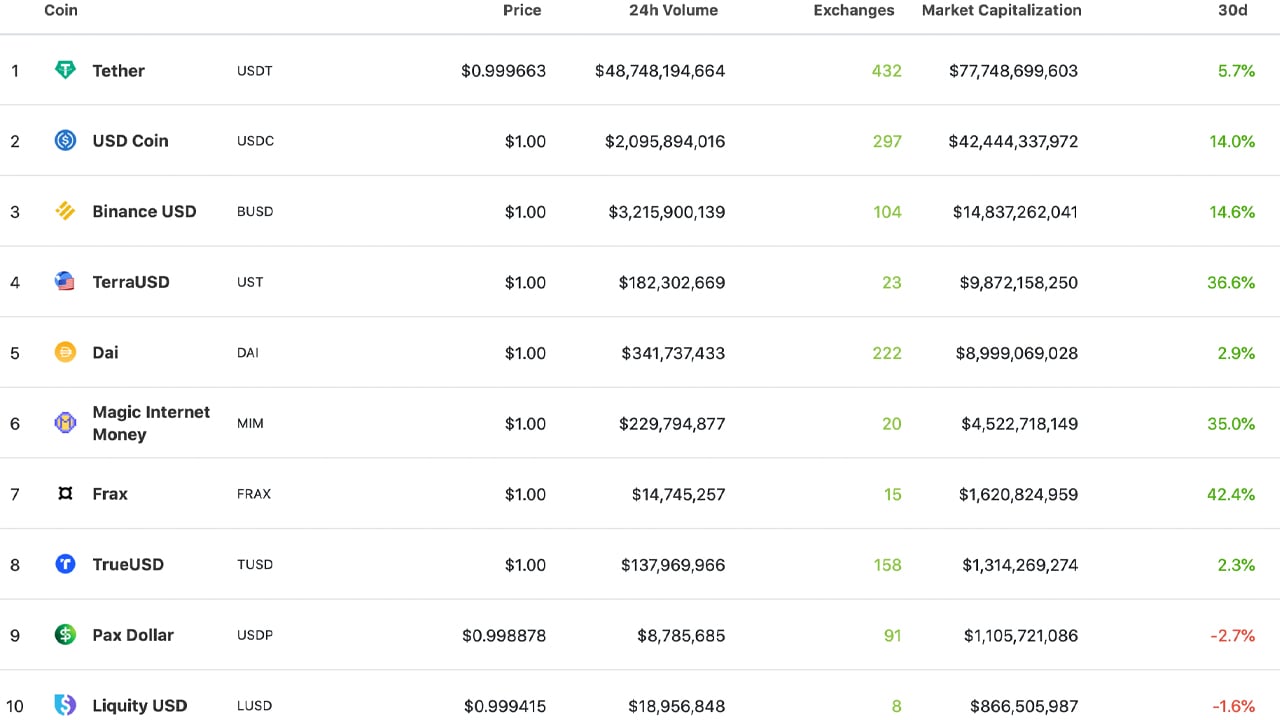

Today there are a large number of stablecoins linked to the value of legal currencies such as the U.S. dollar. The US dollar is the most common stable currency pegged today, but there are other stable currencies that represent the euro and the Swiss franc. On Saturday, the total value of all existing stablecoins was US$167 billion, an increase of 3.59% since the last release on our news channel Stablecoin report. The most dominant stablecoin today is Tether (USDT) Has a market valuation of approximately 77.7 billion U.S. dollars and is distributed on various blockchains.

Tether’s considerable market capitalization accounts for 46.52% of the entire stablecoin economy today. The U.S. dollar coin (USDC) is the second largest stablecoin by market capitalization, at 42.4 billion U.S. dollars.although USDT It rose 5.7% last month and USDC has gained 14% in the past 30 days. The third, fourth and fifth largest stablecoin market valuations belong to BUSD, UST and DAI respectively. The market value of BUSD 14.8 billion U.S. dollars increased by 14.6% last month, and the issuance of UST increased by 36.6%.

60% of today’s transactions are paired with stablecoins

In the past month, the stablecoin DAI issued by Makerdao has risen by 2.9% and is valued at approximately US$8.9 billion. At the time of writing, Terra Protocol’s UST stablecoin is 9.18% larger and is valued at approximately $9.8 billion. The issuance of MIM, FRAX and FEI also increased significantly last month, with an increase of 15.6% to 42.4%. In the past 30 days, the stablecoin originating dollar (OUSD) has soared by more than 102%, and SUSD has risen by 38.7%.

On Saturday, the stablecoin economy received USD 55.4 billion in trading volume out of the total reported trading volume of USD 92.1 billion. This means that in every transaction today, 60.15% of transactions are paired with stablecoins. For example, in terms of market valuation, the leading crypto asset Bitcoin (Bitcoin), have seen about 59.68% of Tether swap transactions today (USDT). The second largest crypto asset, Ethereum (Ethereum), has a similar indicator, because 51.45% of the ether exchange is also related to the tether.

Tags in this story

What do you think of the stablecoin market valuation that has risen about 3.59% in the past 17 days? Please tell us your thoughts on this topic in the comments section below.

Jamie Redman

Jamie Redman is the head of news at Bitcoin.com News and a fintech reporter living in Florida. Since 2011, Redman has been an active member of the cryptocurrency community. He is passionate about Bitcoin, open source code and decentralized applications. Since September 2015, Redman has written more than 5,000 articles for Bitcoin.com News about destructive protocols emerging today.

Image Source: Shutterstock, Pixabay, Wiki Commons, Coingecko.com,

Disclaimer: This article is for reference only. It is not a direct offer or invitation to buy or sell, nor is it a recommendation or endorsement of any product, service or company. Bitcoin Network Does not provide investment, tax, legal or accounting advice. The company or the author is not directly or indirectly responsible for any damage or loss caused or claimed to be caused by using or relying on any content, goods or services mentioned in this article.

[ad_2]

Source link