[ad_1]

This article is a live version of our trade secret newsletter.register here Send the newsletter directly to your inbox every Monday to Thursday

If you asked us what the world trading system needs a month or two ago, we would totally talk about a new, highly contagious variant of the coronavirus and the global debate on manufacturing protectionism.

Our Christmas wish has been fulfilled.First is Omicron, now it is fester Transatlantic controversy The Biden government’s plan for local content requirements for electric vehicles has also been implemented in other countries, including Canada and Mexico. warn a period of time. Depending on whether the United States is really willing, this may be as big or larger as the steel/aluminum dispute, and if it cannot be resolved permanently, it has been temporarily resolved.Regarding the latter topic, today’s trade secret author has a Opinion column On ft.com, address the Biden administration’s claim that its overall trade policy, especially steel tariffs, can be accurately regarded as “worker-centric”. surprise! We are skeptical.

We hope to hear from you.Send any ideas to [email protected] Or email me [email protected]

Fill the gap in the total trade knowledge

We have been discussing trade secret bureaucrats for a week or so, so now is the time to turn again to the increasingly popular issue of the real world and supply chain.

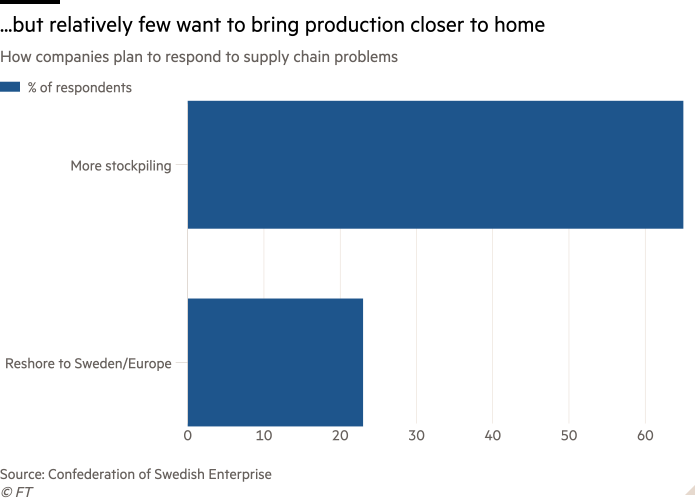

A quick update on the latest news: Omicron threatens to restart the kind of disruption to merchandise trade we saw in the earlier wave of restrictions. Even among the optimists, including ourselves, there is a feeling that the return to normality in 2022 will be further delayed. But does this mean that people are changing whether there is a major reorganization of the supply chain, especially the reorganization of onshore production? As far as we know, not yet. The helpful Swedish Enterprise Confederation recently conducted a survey of its members and shared the results with us. Approximately 75% of importing companies stated that their supply chains are facing major problems, mainly shortages and rising prices. But most companies have not completely changed their supply chains. Although some companies hold larger inventories and purchase from more suppliers, less than a quarter of companies hope to produce onshore in Sweden or even Europe.

Therefore, if it is not subconsciously transferred to shore, what long-term changes may occur? Well, one thing that might help is to give the company a better understanding of what’s going on. This year’s outage revealed huge holes in data about who is producing what, when, where, and how.

Ryan Petersen, CEO of freight forwarding company Flexport, has become one of the most interesting business figures in the supply chain crisis. He said that the thinking in the industry is often dominated by simple explanations. “Before I see the data, I don’t believe this is reality,” he told us earlier this year.

The crisis suddenly made the data his company has been sitting on very valuable. “We have a mobile app with thousands of [truck] Drivers across the United States pick up goods from ports. I have a team with full participation to analyze these data. What is the waiting time at each port? How long must the driver spend in traffic? How much load do they do in a day? What is the average delivery time for each load in traffic? How many miles per hour is this? What variation? “

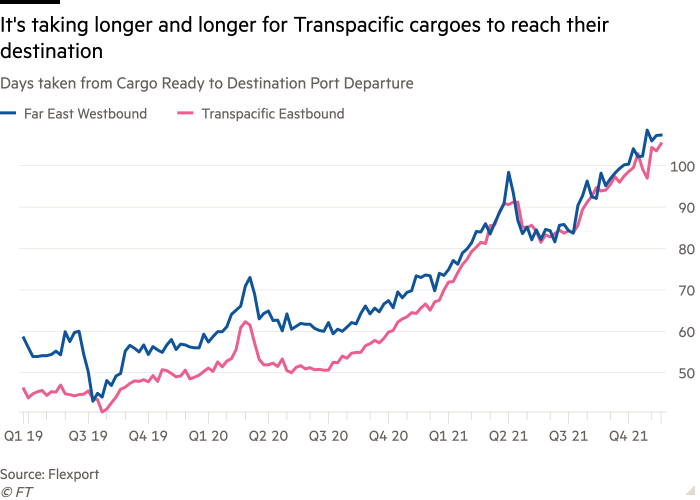

At sea, there are excellent data on the location of ships. Flexport recently used some of this information to create the index shown in the figure below, which highlights the extent to which a journey along one of the world’s major trade arteries has been delayed (look forward to more on this topic tomorrow).

However, Peterson said that the actual container movement is less. Flexport is launching a third-party visibility platform that allows customers to track shipments, which he believes will help users minimize delays.

Manufacturers are also working to better understand the supply chain. We talked with one of our favorite wise men on these issues-John Neal, CEO of Unipart, a British logistics company with strong influence in the field of auto parts. Neal was one of the people who persuaded us at the beginning of the pandemic. Of course, in terms of complex and high-value supply chains such as auto parts, many discussions about local outsourcing have been seriously exaggerated. (He said it is still: “If you look at the British auto industry, today’s internal combustion engines are very unlikely to be transferred to the mainland.”)

Like Peterson, Neal said that the problem now is how to collect and analyze a large number of different data sources, rather than building a supply chain based on experience. “Consider using machine learning to be more effective than just spending a lot of money back, which doesn’t always work,” Neal told us.

Unipart is developing a machine learning product called Dragonfly. It needs a set of machine learning tools to make better predictions, and then use industry-specific knowledge to help it create a more flexible supply chain. “You can start teaching the system to use data about container usage and location, port congestion, vehicle driving, driver shortages and raw materials,” Neal said. “Then you will have more information than before to manage and plan delivery time.” Dragonfly will not directly tell you whether to go ashore, but will make a more informed decision.

All this sounds great, right? The advancement of knowledge. Big data defeated Covid-19, improved efficiency and saved time. But there is a problem.Disturbing Last month’s news Public access to ship location information, which is widely used to evaluate supply chain performance, has seen a sharp decline in the number of ships in Chinese waters. China’s new data protection law restricts this information, saying it is used to monitor its navy.

China’s data localization movement is only heading in one direction, other countries are heading The same wayOf course, if you want to integrate into the global supply chain network, reducing port efficiency is a kind of self-destruction, but this is obviously a trade-off that Beijing is willing to make.

This is only our first attempt at data and supply chain management issues: we are happy to hear everyone’s views on this issue. To repeat what we said before, it takes time to reorganize complex production systems spread across multiple countries. At least while doing it, there are more figures to see.

Trade ties

On the occasion of the 20th anniversary of China’s accession WTODuring the accession negotiations, Karl Falkenberg, the EU’s chief negotiator, expressed his views on his past and future membership.

South Korea Will apply join in Comprehensive and progressive agreement Dissatisfaction with China after the doubts about the Trans-Pacific Partnership dissipated.

This UK seem Surrender again In negotiations with Brexit A generation, Which is quickly becoming A once-a-year event. And, in winning Japanese farmers, The British government has Took the first step (Nikkei Index, USD) Removal of import restrictions Food imposed after the Fukushima nuclear accident 10 years ago.

Supply chain dilemma continue Toyota, Including Partially suspended (Nikkei, $) Due to delays in sourcing parts from Southeast Asia, the operations of four factories in Japan were affected. Alan Beatty and Francesca Regalado

[ad_2]

Source link