[ad_1]

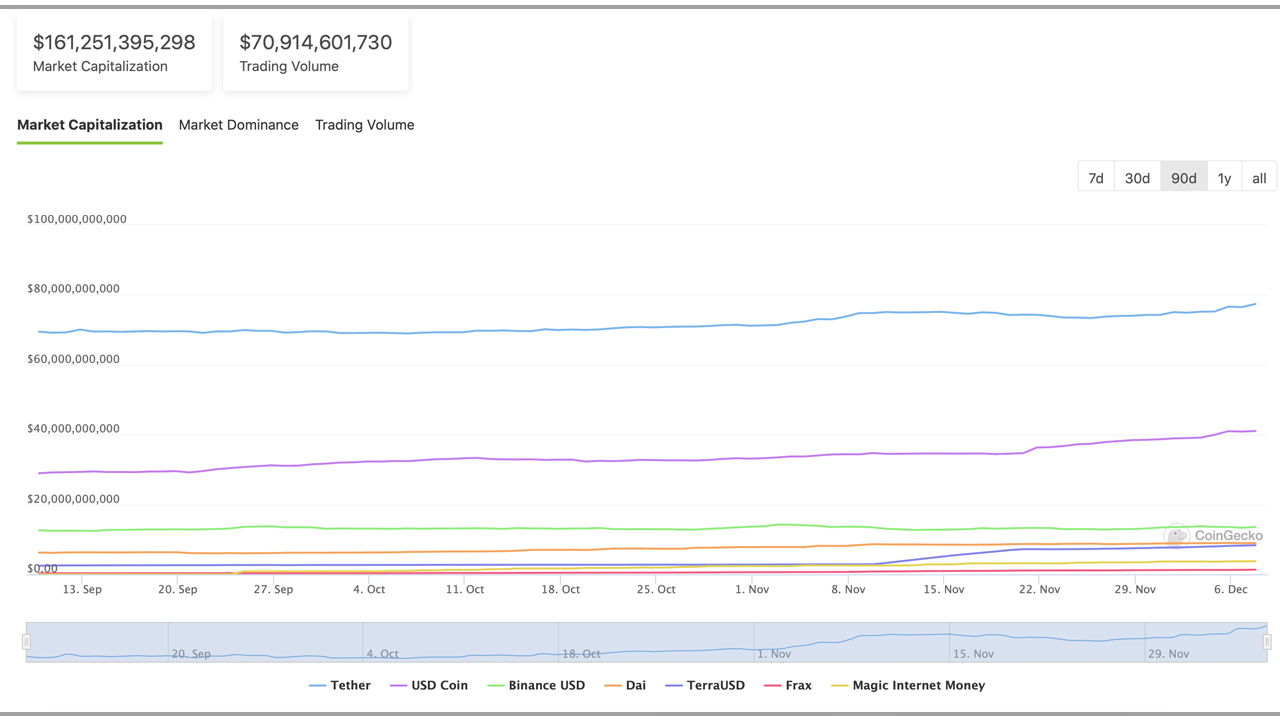

In the last week of November, the stablecoin economy broke through the 150 billion U.S. dollar mark for the first time, with Tether and U.S. dollar tokens dominating. In just 10 days, the stable currency economy has accumulated another 11 billion U.S. dollars in value, and the U.S. dollar and the Terra U.S. dollar have expanded significantly in the past 30 days.

The currency-linked token economy has increased by 11 billion U.S. dollars

Whether people like it or not, stablecoins are definitely an important part of the crypto industry. In ten days, the entire stablecoin economy grew from 150 billion U.S. dollars to 161.2 billion U.S. dollars today, an increase of 7.33%.

Month after month, the stablecoin market continues to expand, and the token tether (USDT) Is the largest stablecoin by market capitalization. Statistics show that USDT The market value is about 77.3 billion U.S. dollars, and its market value increased by 6.1% in the last month.

The U.S. dollar coin (USDC) is today’s second largest stable currency, with a market valuation of approximately US$41 billion. In the past 30 days, the market value of USDC has increased by 19.5%.Sum USDT Together with USDC, it accounts for 4.75% of the entire crypto economy.

In terms of the stablecoin economy alone, these two tokens USDT And USDC accounted for 73.21% of the USD 161 billion of fiat-linked tokens. Although Tether accounts for most of the trading volume, USDC’s stable currency trading volume is second only to BUSD, ranking third.

In the past month, the issuance of Terra and Origin stablecoins has surged

Terra’s stablecoin UST has the largest increase in the top ten stablecoin markets in the past 30 days, with its market value increasing by 190%. A month ago, Terra’s UST market value was only $2.88 billion.

The algorithmic stablecoin UST is valued at approximately 8.3 billion U.S. dollars today, with a global transaction volume of 178 million U.S. dollars. The market value of UST is slightly lower than DAI’s valuation of USD 8.95 billion. Terra’s algorithmic stable currency is also higher than Abracadabra.money’s Magic Internet Currency (MIM) and its $3.7 billion market.

Origin Protocol (OGN)’s stablecoin Origin U.S. Dollar (OUSD) has soared 721% in the past 30 days. The overall market valuation of OUSD is approximately 226.5 million U.S. dollars, with a transaction volume of 2.7 million U.S. dollars. Stablecoins rank 15th in today’s valuation of digital assets linked to the U.S. dollar.

Other stablecoins that have seen a significant 30-day movement include frax, pax dollars, and liquid dollars. In addition to fiat-linked tokens linked to the value of the U.S. dollar, a large number of stablecoins based on different fiat currencies (such as the euro and Turkish lira) have also seen significant growth in 30 days.

Tags in this story

What do you think of the stable currency economy in the past ten days and the growth of UST and OUSD in the past month? Please tell us your thoughts on this topic in the comments section below.

Image Source: Shutterstock, Pixabay, Wiki Commons, Coingecko.com,

Disclaimer: This article is for reference only. It is not a direct offer or invitation to buy or sell, nor is it a recommendation or endorsement of any product, service or company. Bitcoin Network Does not provide investment, tax, legal or accounting advice. The company or the author is not directly or indirectly responsible for any damage or loss caused or claimed to be caused by using or relying on any content, goods or services mentioned in this article.

[ad_2]

Source link