[ad_1]

While policymakers in developing countries are fighting the continued spread of the coronavirus, they are also facing the economic threat of inflation—not just at home.

Rising prices in major economies (especially the United States) have intensified investors’ expectations for interest rate hikes. This pushes up bond yields, and as buyers demand higher returns, it is more expensive for other countries to sell bonds.

What should have been good news — the beginning of a global recovery — has become a threat: Borrowing costs in countries such as South Africa and Brazil will reach dangerously high levels, throwing their already precarious public finances into chaos.

Inflation: a new era?

Prices in many major economies are rising. The British “Financial Times” investigates whether inflation will recover permanently.

Day 1: For decades, advanced economies have not faced rapidly rising inflation. Is this going to change?

Day 2: Central Bank Governors reach a global consensus on how to best promote low and stable inflation Has collapsed.

Day 3: The coal mine canary of U.S. inflation: Second-hand car.

Day 4: How to The virus is destroyed Official inflation data.

Day 5: Why price increases in developed economies are a problem for debt-ridden developing countries.

Tatiana Lysenko, chief economist for emerging markets at Standard & Poor’s Global Ratings, said: “Emerging economies should worry more about U.S. inflation than their own inflation.”

She said that it’s not just inflation and rising yields in the US that have pushed up borrowing costs in developing countries. The broader risk is that the U.S. economy will lead the emerging economies, leading to outflows of their stocks and bonds, and ultimately leading to currency weakness.

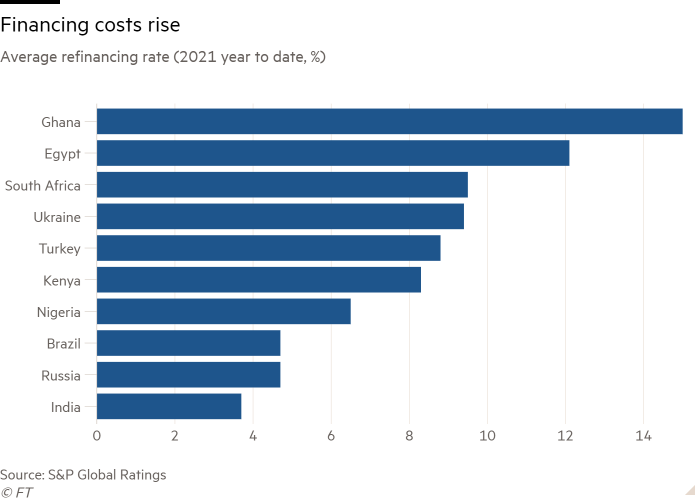

Although rich countries can borrow at very low interest rates during a pandemic, many developing countries are already facing higher financing costs.

Standard & Poor’s data shows that 15 of the 18 largest advanced economies have refinancing costs more than one percentage point lower than their average borrowing costs. Most people only pay a fraction of 1%. A 1% increase in financing costs is easy for most people to bear.

In an interconnected world with massive capital flows, the U.S. rate of return has a significant spillover effect

Developing countries cannot say that. According to Standard & Poor’s data, Egypt must refinance debt equivalent to 38% of GDP this year, with an average interest rate of 12.1%, which is higher than its average cost of 11.8%. Ghana pays 15%, while the average is 11.5%.

The danger is not only in very high interest rates. Brazil’s average interest rate for refinancing this year is 4.7%, which is lower than the average cost of its existing debt. But it does this by selling bonds that must be repaid faster than in the past.

This is out of touch with Brazil’s years of work to sell long-term and fixed-rate debt to make its finances more sustainable. Last year, the average maturity of its new debt was two years, lower than the five years in 2019.

Brazil needs to refinance debt equivalent to 13% of GDP this year-a lower proportion than small countries, but a higher total, and it may be hindered by rising interest rates or slower-than-expected recovery.

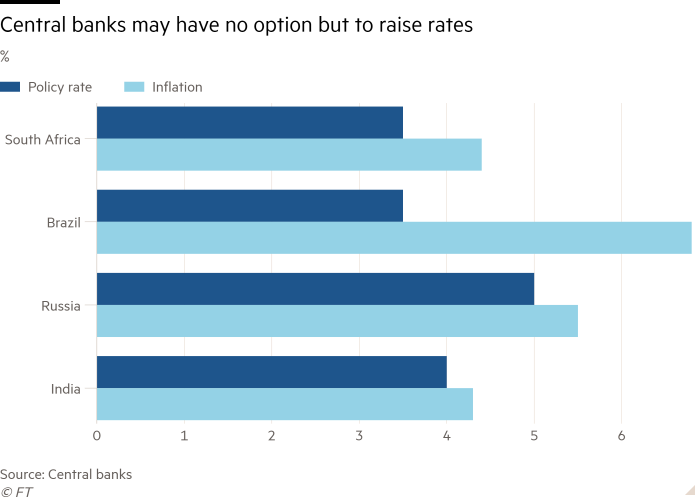

After inflation exceeded its target range of 2.25% to 5.25%, its central bank has raised interest rates twice this year to calm price pressures. The next meeting later this month may be raised again, and the benchmark interest rate is expected to be 5.5% by the end of the year, which is higher than the record low of 2% in March.

William Jackson of Capital Economics said that Brazil is a clear example, showing that inflation and rising yields pose a threat to debt sustainability. “It stretches public finances, inflation rises, and the central bank raises interest rates, which increases debt servicing costs.”

He said that South Africa is in the same category as Egypt and other countries with large refinancing needs.

There are mitigating factors. For example, Brazil, South Africa, and India all rely more on domestic lenders than foreign lenders. This makes them less susceptible to capital outflows than during the debt crisis at the end of the 20th century.

In particular, India has turned to its domestic banking system to issue benchmark 10-year bonds, with interest rates capped at approximately 6%. During the pandemic, it also borrowed shorter-term loans, although its low refinancing needs this year—only equivalent to 3.3% of GDP—make it less susceptible to rising interest rates.

But William Foster, vice president of the Sovereign Risk Group at Moody’s Investors Service, said that India’s fiscal problems make it dependent on debt rather than government revenue to deal with the pandemic.

“India has a huge fiscal deficit and a very high debt stock,” he said. “The most important thing for debt sustainability is to achieve a higher medium-term growth rate, through reforms and other measures to squeeze in private investment that we have not seen for many years.”

If, as many policymakers hope, the increase in inflation this year is temporary, then interest rates in emerging economies may not have to rise sharply.

The governor of the Brazilian Central Bank, Roberto Campos Neto, said at a meeting this week that the question is whether inflation is temporary and is justified by growth, or whether the central bank should raise interest rates further. “The first case is benign for the emerging world,” he said. “The second one is not.”

Lysenko said that the rate of increase in food and commodity prices has boosted consumer inflation expectations. If interest rates rise sharply, it will become more difficult to reduce the debt of developing economies to sustainable levels—and achieve growth.

“In an interconnected world with large flows of capital, the U.S. rate of return has a significant spillover effect,” she said. “too early [for emerging markets] Tighten [monetary policy], As for doing so now may undermine their recovery. But some countries may not have much room not to tighten. “

[ad_2]

Source link