[ad_1]

Few things are more divided than the “Inheritance Tax” for the readers of the Financial Times. In some cases, taxation is unfair-a punishment for hard-working parents who wish to transfer their property to their children. For other people, taxes are ineffective, because the rich avoid taxes and get unfair opportunities, giving future generations a huge advantage in life.

The Covid-19 pandemic has brought new power to this debate, and it is necessary To increase taxes Once security is restored, public finances can be strengthened. Right now, Prime Minister Rishi Sunak is playing cards near his chest and may collect any such taxes, but many experts suggest that you consider levying wealth taxes, including IHT.

One of the latest views put forward by the OECD is that Phu Quoc Club. Although it has no direct position in the debate in the UK, it provides an international reference point that the Minister of Finance can consider. Sometimes it provides a path for global change, just like the ongoing corporate tax reform.

Therefore, its view of IHT is crucial. Especially when the experts in its report of this month did not stop pointing out the many quirks in the UK. These range from special exemptions for farmers and state landowners, to systems that impose taxes on the inheritance of the deceased rather than those who acquire it.

The OECD recommends that governments, including the United Kingdom, make more use of IHT to promote equality and increase taxes to restore their pandemic-stricken funds.

FT Money studied the comparison of the British system with other countries, the main proposals of the OECD, and whether the latest intervention in inheritance tax foreshadows change.

Britain stands out

Of the 36 OECD countries analyzed in the report, 24 taxed wealth transfers, including the United Kingdom. Other countries, including Australia, Canada, Israel and New Zealand, do not.

The United Kingdom is the only three countries (along with Denmark and the United States) that tax the inheritance of deceased donors. Other countries impose taxes on recipients.

The United Kingdom is also one of the few countries that impose a flat tax rate on a flat tax rate. 15 countries use progressive tax rates-the tax rate increases with the value of the estate-in the case of Belgium the maximum is 80%.

In contrast, seven countries, including the United Kingdom, impose flat tax rates. The highest combined tax rate between the United Kingdom and the United States is 40%. In contrast, Ireland’s rate is 33% and Portugal’s rate is only 10%.

Several countries/regions use a fixed rate, depending on the relationship between the donor and the recipient. In Italy, the proportion of family relatives ranges from 4% to 8% of other beneficiaries, and from 15% to 36.25% in Denmark.

Most OECD countries have some form of mandatory inheritance rights, and some of them (usually spouses and children) are automatically entitled to inheritance.

The United Kingdom, the United States and Latvia are outstanding in allowing donors to decide who to leave their assets to. The situation in Scotland has changed. Movable assets (including cash) are subject to mandatory inheritance rules, but are not subject to land restrictions.

Tax recipients, not inheritance

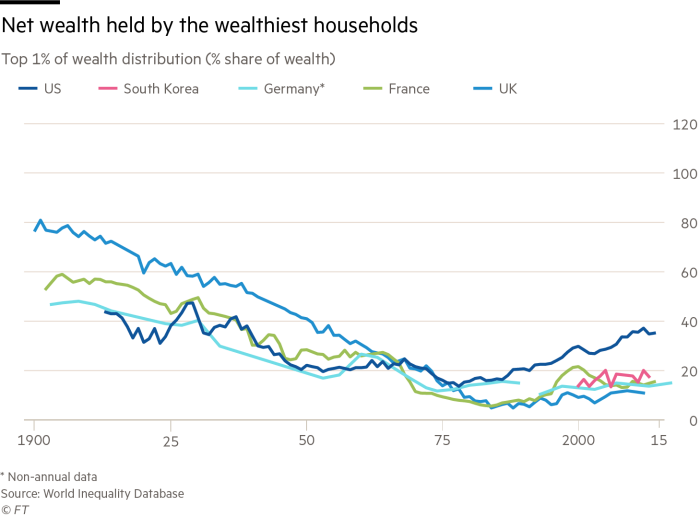

The pandemic has exacerbated the economic divergence between the rich and the rich, and has heightened concerns about the role of inheritance in deepening social rifts. Or, as the OECD puts it: “The Covid-19 crisis has different impacts on different population groups, which may exacerbate the difficulties of certain families and increase the gap between families with older assets and younger families.”

The study found that this is especially the case, because wealthier families are more likely to receive inheritance or lifetime gifts. Among the top five wealthy families, the proportion of families receiving inheritance or lifetime gifts ranges from 39% in Canada to 66% in Finland.

The author says that in many OECD countries, these trends are worsening and are likely to worsen. They predict that if asset prices continue to rise, the value of inheritance will increase, and as the baby boomers age, the number of inheritances will increase. At the same time, it is difficult for many people to buy houses due to high prices, and it may be difficult for the younger generation to accumulate wealth on their own.

In order to “promote equal opportunities”, the report advocates taxing the recipients of gifts and inheritances, rather than taxing donors’ inheritances as currently done in the UK.

The OECD logic is widely accepted among British experts, but many people warn that political opposition to this change will make it impractical, because normally wealthy people think they should pay as little tax as possible. Money transfers assets to children.

These views seem to be deeply rooted in the British elite’s attachment to land and property for a century.Edward Troup, the former first permanent secretary of the UK Revenue and Customs Service, said: “The frustrating truth is that we are obsessed with the housing wealth of this country, and we are also obsessed with Don’t pay IHT. “

Trump believes that “taxation [IHT] On the basis of the recipient, it is always wiser than taxing the donor. He said: “If you inherit the inheritance, you can do nothing except to be a good child occasionally, which is absolutely fine. “Why on earth, if you receive £100,000, you shouldn’t Is this taxable? “

Lynne Rowland, tax partner of the accounting firm Moore Kingston Smith.Added that the equal opportunity argument may appeal to governments that have promised “upgrade” country.

But Troup said that although meaningful measures have been taken, there will still be great political difficulties in implementing this measure.

The financial situation of the move to a receiver-based system is poor. Statistics from the OECD show that tax recipients rather than donors currently do not make more money than the UK. “Any reform has no political appeal. In the government, only by raising a large amount of funds can serious tax reforms begin.”

Lifetime gift tax

In the UK, individuals who give up assets during their lifetime can benefit from the “potential tax-free transfer” system-often referred to as the “seven-year rule.” According to this rule, if the donor lives for at least 7 years after donating the gift, the assets donated during the life of the individual are excluded from the IHT. If the person bequeathes these assets to their children after death, they should pay inheritance tax (above the threshold of £325,000).

Elaine Shiels and Sarah Saunders of the accounting firm RSM said the rule effectively “enables the wealthy and those with easily transferable assets to make a lot of money within a few years. Tax-free gifts.”

OECD agreed. When it came to the British rules, it said that the “chance of avoidance” created by the tax deduction for lifetime donations could be exempted.

It proposes to impose a “lifetime wealth transfer tax” on gift recipients. In the case of tax exemption, you will get a lifetime tax-free wealth, and the tax amount exceeds this threshold.

This is not the first time that a tax on lifetime gifts has been proposed. Members of the Office of Statutory Tax Simplification and the Parliamentary Group on Inheritance and Intergenerational Equity have proposed changes to the gift tax in the UK.

This OTS recommendations Numerous gift allowances were replaced by one allowance per person. Members of Congress proposed in January 2020 to abolish all seven-year rules for IHT exemptions, lower the tax rate from 40% to 10%, and apply it to gifts of life and death.

Arun Advani, an assistant professor at the University of Warwick and a member of the Independent Wealth Tax Commission that reported last year, said that a lifetime gift tax on recipients is a “principle approach.”

However, he warned that this would involve more management of HMRC and taxpayers.He said there are other ways to “raise more funds and reduce political pain.” If I am surprised [reforming IHT] It is indeed the first place where politicians go. “

Tighten and remove IHT exemptions

Although tax experts believe that the UK is unlikely to follow the OECD’s recommendations to impose taxes on heirs or severely tighten lifetime gifts, they believe that the UK is more likely to accept the proposal to reduce exemptions. The OECD said: “Countries should consider reducing tax breaks for which there is no good reason, and tax breaks are often regressive.”

It cited OTS’ UK research showing that the two main IHT reliefs for commercial and agricultural assets mainly benefit the wealthiest households.

Zena Hanks, a partner at Saffery Champness accounting firm, said that her clients sometimes worry about the changes in these remedies “chatting”.

She warned that scrapping or significantly tightening them would create complex problems for many companies and farmers. She said: “People want to budget, they don’t want surprises.”

Traup believes that the “large-scale relief” of industry and commerce “does not have any credible economic arguments”-citing the analysis in the report and found that the heirs who managed the enterprise did not perform well.

Troup said that the cancellation of IHT relief would “make those affected scream.” He is “disheartened” by the prospects of the current government, but he said the time for reform is coming.

Rowland believes that this pandemic is likely to advance this moment. She said: “The door to the government is opening, but it depends on whether they are brave enough to pass the government.”

[ad_2]

Source link