[ad_1]

Nigeria has adopted a variety of exchange rate systems to avoid a complete devaluation of the naira, but this system has aroused criticism from the International Monetary Fund.

after Emele Onu and Tope AlakeBloomberg

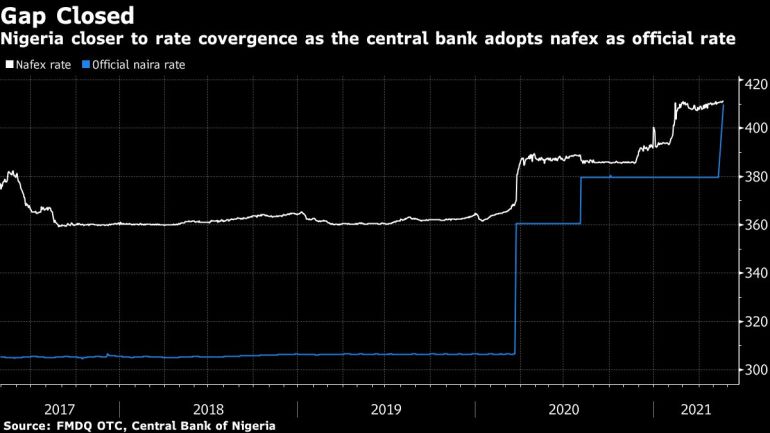

The Central Bank of Nigeria depreciated the Naira by 7.6% against the U.S. dollar because the authorities of Africa’s largest oil producer switched to a single exchange rate system using the local currency.

The Central Bank of Abuja, Nigeria replaced the fixed exchange rate of 379 naira with the more flexible Nafex (also known as the investor and exporter exchange rate) for the US dollar for formal transactions. The average exchange rate this year is 410.25 naira/US dollar. The data was published on its website on Tuesday.

“We found that we no longer use the so-called CBN official exchange rate for transactions,” Governor Godwin Emefiele told reporters at a monetary policy briefing earlier on Tuesday. “We are still undergoing a managed float. We are monitoring the market and observing what is happening to us to ensure that the right things are done for the benefit of the Nigerian economy.”

The bank maintained its interest rate at 11.5%, which was consistent with the median value surveyed by Bloomberg.

Neville Mandimika, an economist at Rand Commercial Bank in Johannesburg, said: “As the fragmentation of the exchange rate market has always been the cause of confusion and arbitrage, it is welcome to formally unify these exchange rates. “

Nigeria has adopted a variety of exchange rate systems to avoid a complete devaluation of the naira by maintaining a fixed pegged exchange rate for official transactions and a weaker exchange rate for non-government-related transactions. This currency management system has been criticized by the International Monetary Fund (IMF), and the World Bank has retained $1.5 billion in loans to promote more foreign exchange reforms.

Nafex is a spot exchange rate that was launched in 2017 to increase the liquidity of the U.S. dollar and encourage the inflow of foreign investors who left the country after the 2016 economic crisis. After the Covid-19 pandemic caused oil prices to plummet, the West African country suffered from even more severe hard currency scarcity last year, forcing it to depreciate its local currency twice.

Although crude oil contributes less than 10% of the country’s gross domestic product, it accounts for almost half of all foreign exchange revenue and half of government revenue.

Chapel Hill Denham analyst Omotola Abimbola said on the phone: “The key to the market is now to allow investors and exporters to have more flexibility in the pricing of window rates in order to completely narrow the price difference between Nafex and the parallel market.”

Analysts such as Simon Kitchen and Mohamed Abu Basha of Cairo-based EFG Hermes said that the latest central bank move is expected to increase confidence in policy making, but as investors wait for more dollar liquidity, the recovery of portfolio inflows will not be immediate. .

[ad_2]

Source link