[ad_1]

The US surplus season is coming to an end, and although it is still in full swing across the Atlantic, one thing is clear: analysts have far underestimated the huge wealth brought about by the global economic recovery in the first quarter of 2021.

stock market? This seems to herald the right choice.

In the United States, almost all S&P 500 companies have reported this news, which has become the best quarter in at least a decade, with year-on-year revenue growth of more than 50%. About 87% of the companies that ended last week exceeded expectations, which is the highest level since Refinitiv started tracking data.

Although the Stoxx 600 in Europe is only about half completed, based on the reported results and estimated comprehensive data, year-on-year revenue growth is expected to reach 92.8%. The European continent’s rebound was stronger because the continent’s economy suffered a heavy blow from the pandemic last year. On both sides of the Atlantic, income It has now surpassed its pre-pandemic level.

DWS co-head of stock Thomas Schuessler (Thomas Schuessler) said: “In the United States, your income season is very good.” “And why it is in [Europe]? This is the global economy. “

The budding vaccination campaign and loose pandemic restrictions blinded analysts.before Bank of America As the reporting season kicks off, analysts expect the earnings of companies in the Standard & Poor’s 500 Index to grow by only 25%.

In Europe, with another wave of Covid-19 sweeping across the African continent, the consensus in the market even dropped from 44% at the end of January to 38% at the end of February. As of the end of the first quarter, it is still estimated to be 47%, and as in the United States, the company’s deliveries are twice expected.

“The data may continue to improve week after week,” said Ann Miletti, head of active assets at Wells Fargo Asset Management.

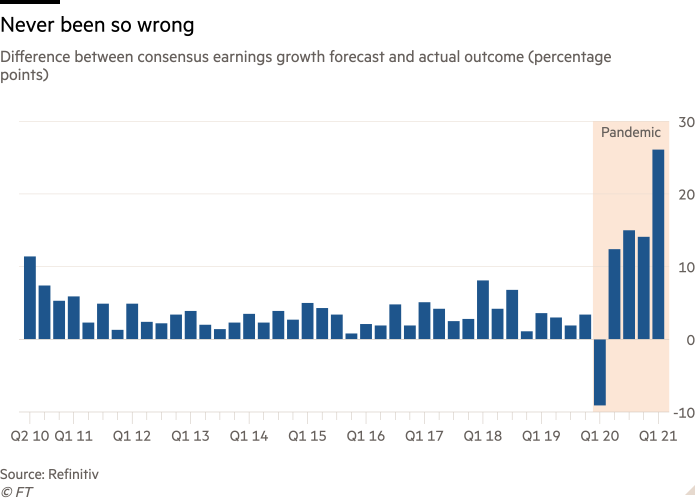

The mismatch between expected and actual results has always been a feature of the pandemic, highlighting the difficulty for analysts and companies to adapt to rapidly changing conditions. Wall Street failed to fully predict the economic loss in the first quarter of last year, when analysts underestimated a 10% drop in S&P 500 earnings.

The stock market has largely not been driven by improved performance, which shows that bullish investors have priced a strong recovery as a price, even if more timid analysts have not included it in their forecasts.

From the beginning of the year to the beginning of the earnings season, both have risen about 10%, and since then, the stock prices of S&P 500 and Stoxx 600 have been flat.

According to data from Bank of America, within a day after the report was released, the S&P 500 companies that exceeded expectations were only 0.5 percentage points higher than the index and 1.5 points lower than the historical average.

Investors have shifted their attention from historical gains to the increasing risks that are about to emerge.

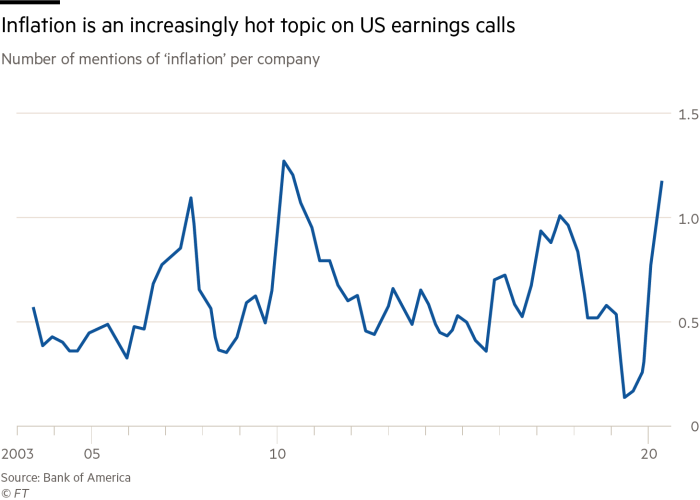

The most important thing is: the increase in input costs, the most obvious is the increase in raw materials and transportation costs. According to the Bank of America, the term “inflation” has gone from almost never appearing to every company being mentioned at least once on average.

Executives said they will pass on to consumers what many believe is temporarily higher input costs in order to keep profits. But Wall Street is still worried, especially as to whether it will prompt the Fed to tighten monetary support faster than expected.

“When people say this is temporary, I understand what they are talking about, but who cares?” asked Savita Subramanian, head of U.S. equity and quantitative strategy at Bank of America. “Any act of violence, you should pay attention to it and consider positioning around it.”

[ad_2]

Source link